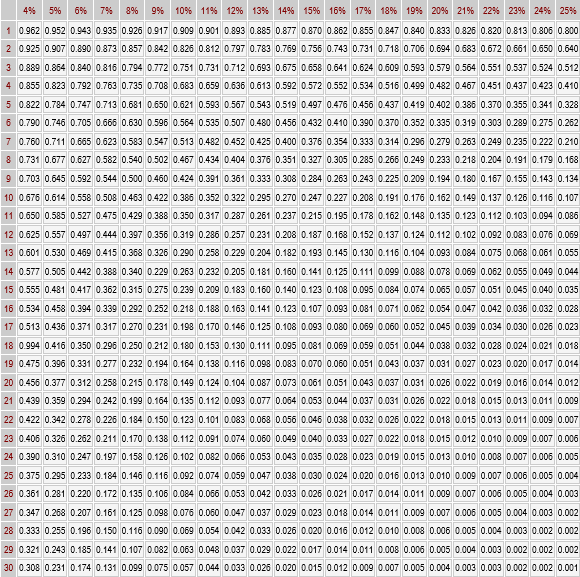

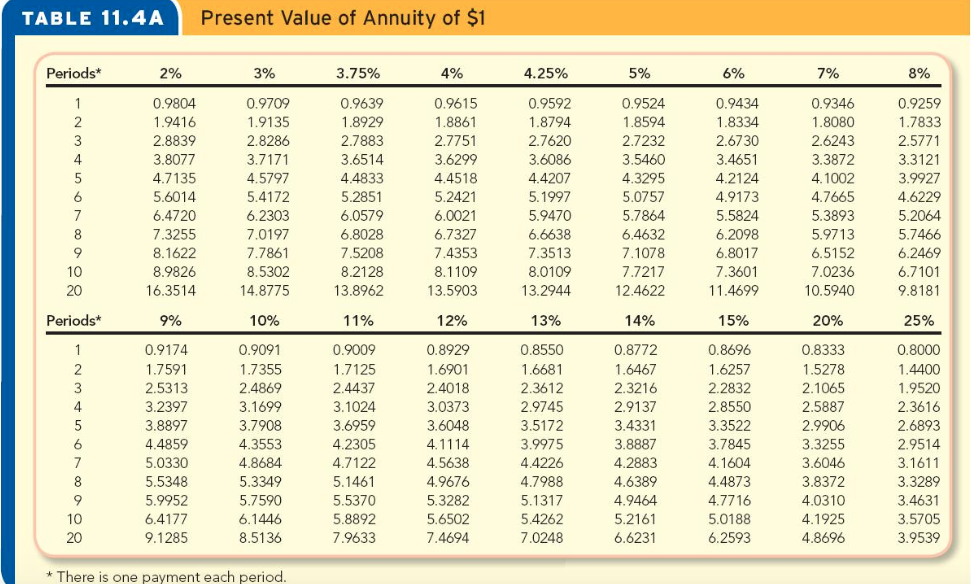

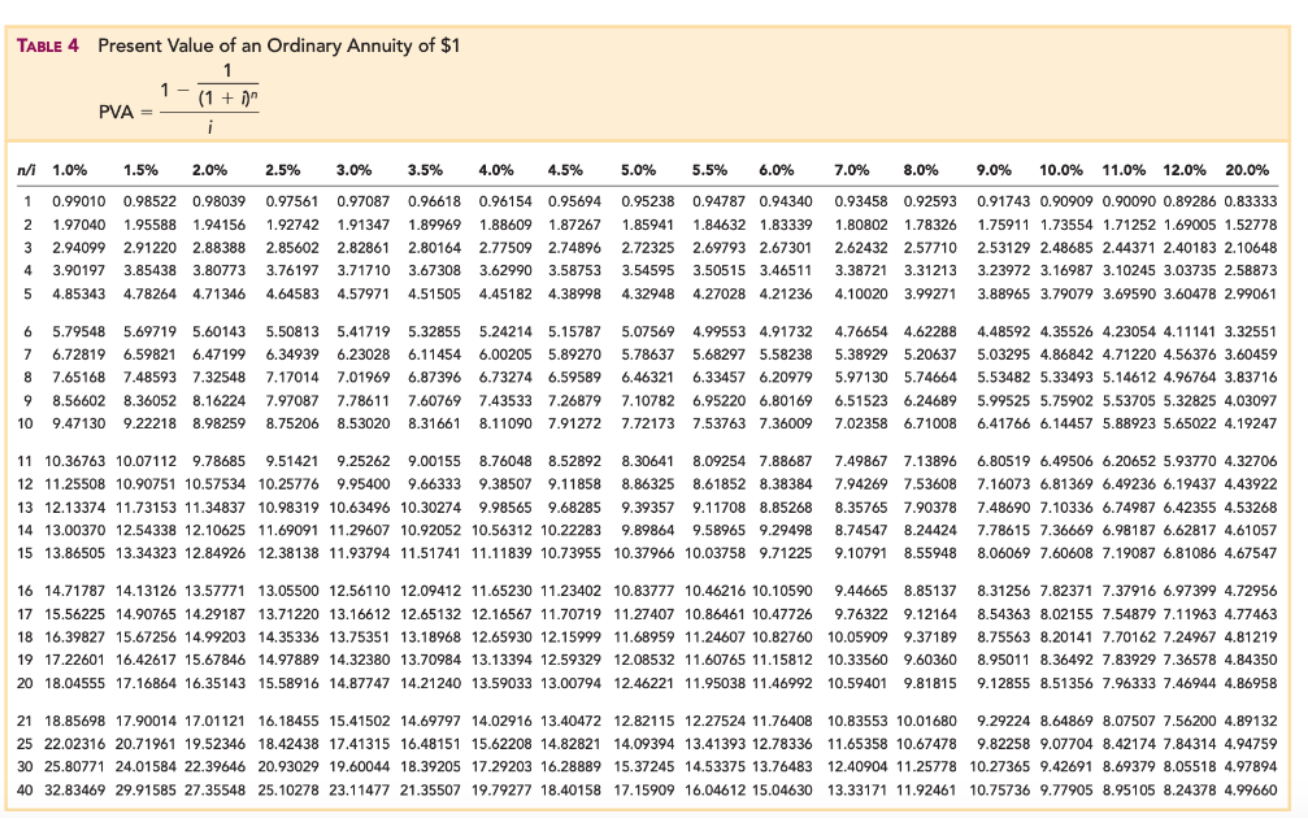

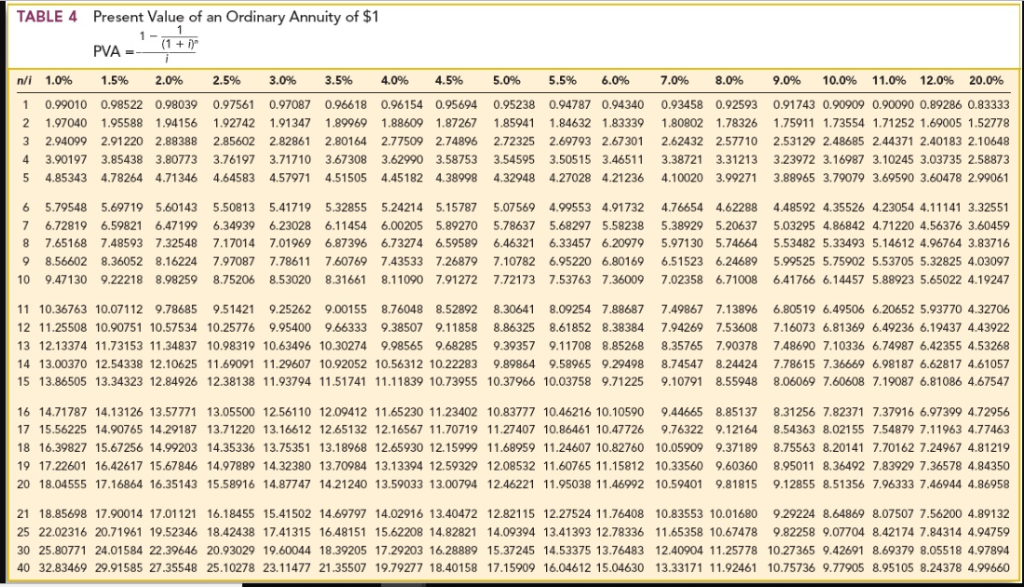

Present value of annuity table of $1

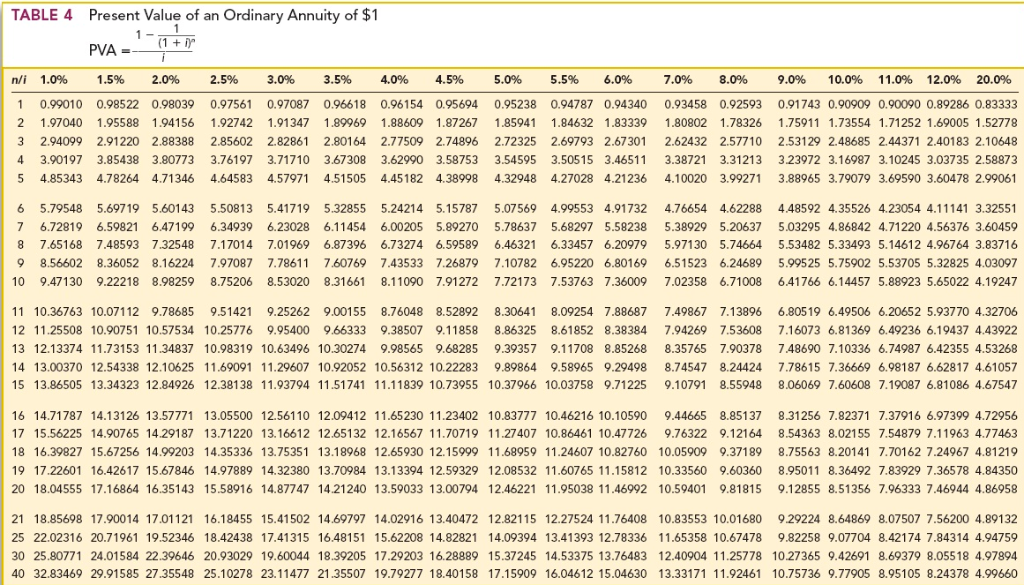

Click here to view Exhibit 14B-1 and Exhibit 14B-2 to determine the appropriate discount factor using tables. Net present value method.

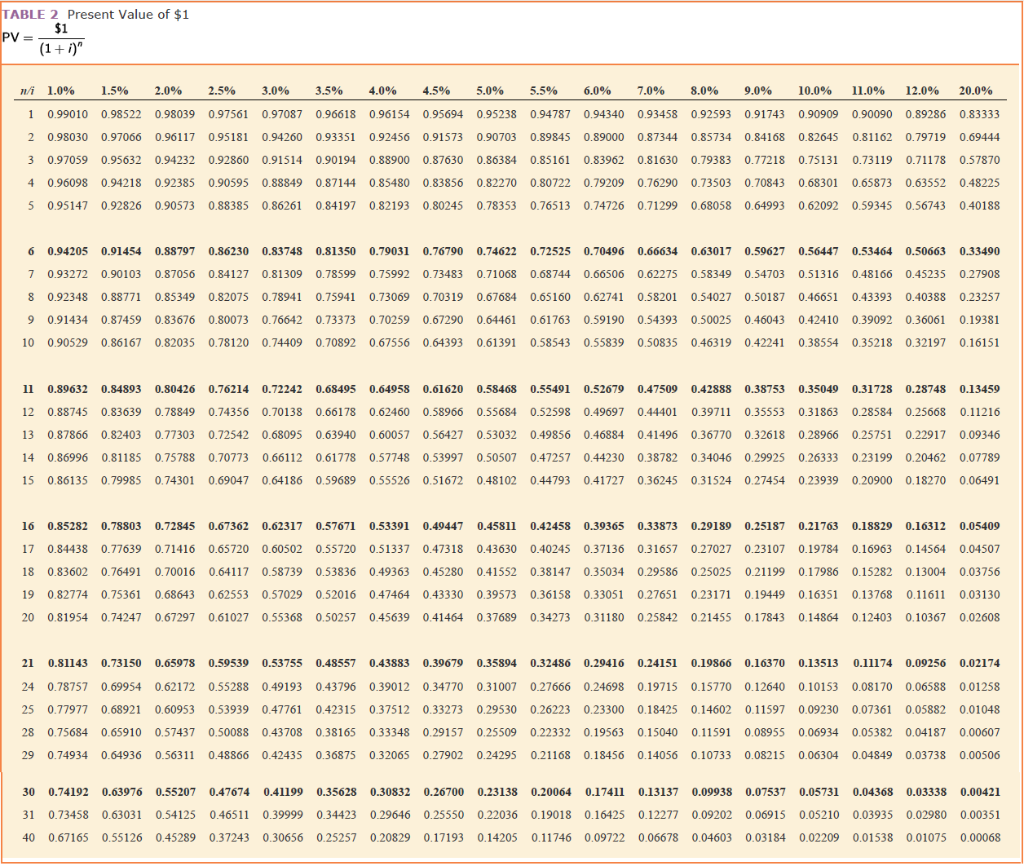

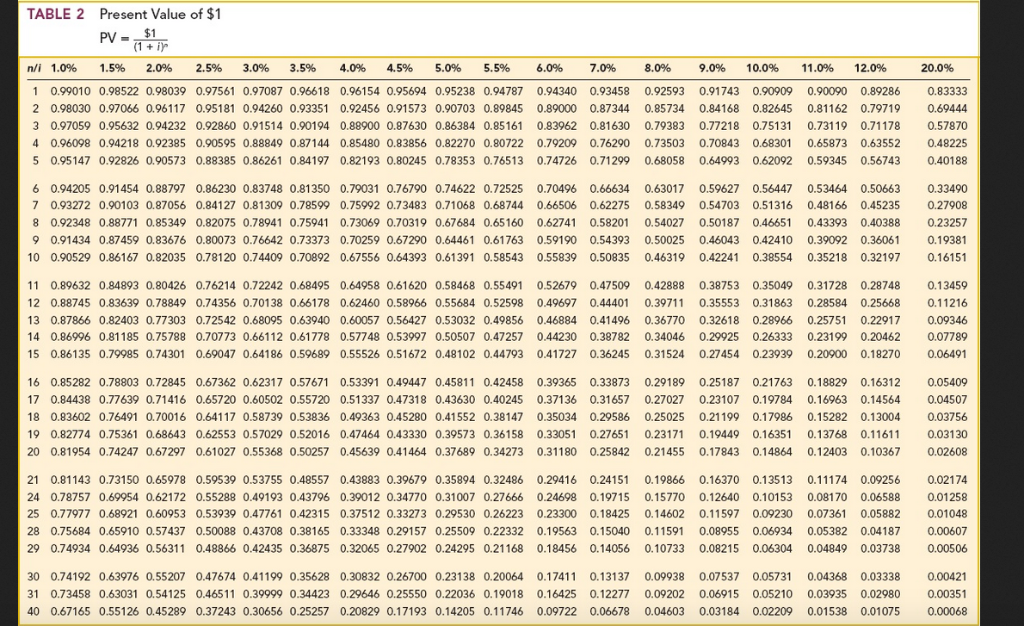

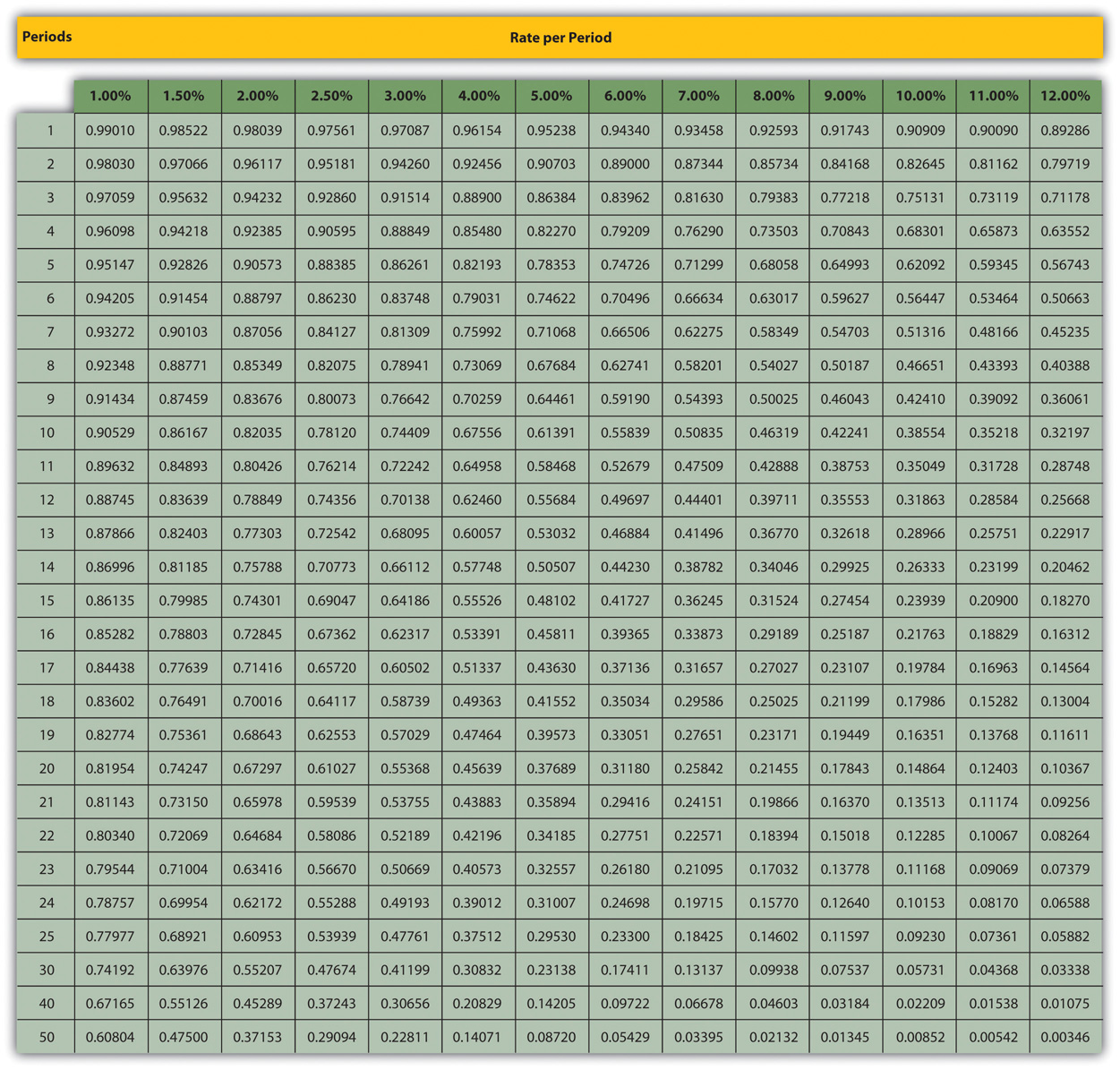

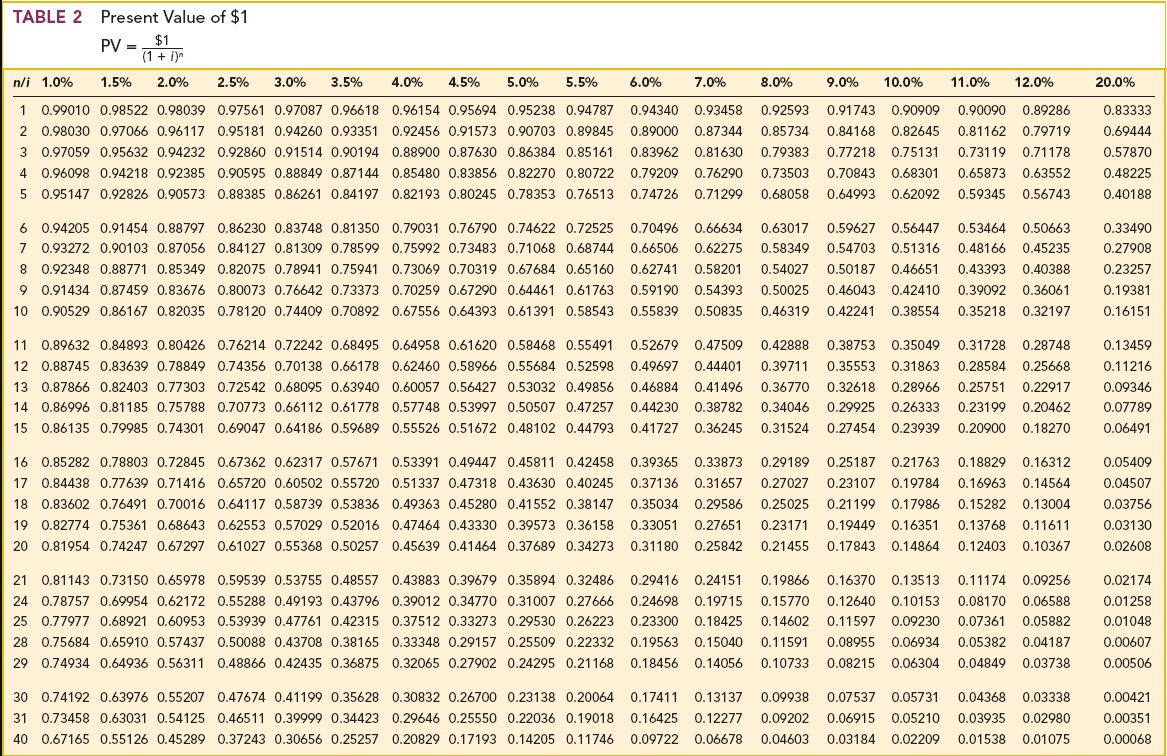

Present Value Of 1 Table Accounting For Management

I Interest rate expressed as a decimal n Number of years the investment will be held.

. In millions except per share data. If you have to add two or more amounts to figure the amount to enter on a line include cents when adding the amounts and round off only the total. Project A requires an investment of 1 mn which will give a return of 300000 each year for 5 years.

Calculate the net present value for each product. Present Value of 1 Annuity Table PVIFA Present Value of 1 Table PVIF Present Value Formula Derivations. Let us take the example of David who seeks to a certain amount of money today such that after 4 years he can withdraw 3000.

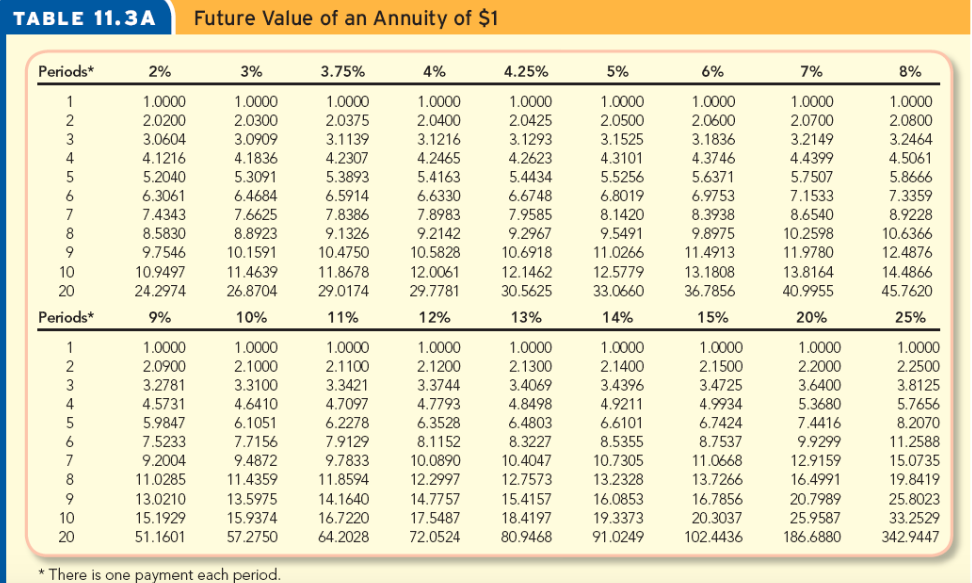

A list of present value formulas for a future sum annuity growing annuity. Calculate the internal rate of return for each product. F Future value of investment.

Calculate the payback period for each product. General Electric has the opportunity to invest in 2 projects. Present Value Example 2.

After computing the internal rate of return factor the next step is to locate this discount factor in present value of an annuity of 1 in arrears table. Notice that the projects in the above examples generate equal cash inflow in all the periods the cost saving in example 2 has been treated as cash inflow. Rent of 8100 due at the end of each quarter February 1 May 1 August 1 and November 1.

1 par value per share. As of January 1 2022 life expectancies are calculated with updated life expectancy. Present Value of 1 Table.

Annuity Present Value Interest Factor. The applicable discount rate is 5 to be compounded half yearly. Use the PV of 1 Table to find the rounded present value figure at the intersection of n 12 3 years x 4 quarters and i 2 8 per year 4.

The program uses this value to calculate the annuity payout the present value of the annuity payments and the present value of the remainder for gift tax purposes. Value at date of death. This could be done one at a time but this might be tedious.

What is the present value of a 4-year annuity if the annual interest is 5 and the. Net present value method with uneven cash flow. Create a table of present value interest factors for an annuity for 1 one dollar based on compounding interest calculations.

For example 139 becomes 1 and 250 becomes 3. By default this value is the same as the Pre-discounted Fair Market Value. P Present value of investment.

The following table presents the companys summary financial results. A 15-year lease would have a. Calculate the amount that David is required to deposit today.

F P1 in. Present value of a 1 ordinary annuity or 1 annuity due. EstateShield 10 keeps your money close with up to 10 free withdrawals each year.

Present value of an annuity. F 10001 00510. If you are entering amounts that include cents make sure to include the decimal point.

Average rate of return or accounting rate of return method. With this method the amount to be distributed annually is determined by amortizing your account balance over your single life expectancy the uniform life expectancy table or joint life expectancy with your oldest named beneficiary. Present Value of an Ordinary Annuity or Present Value of an Annuity Due Table.

Additional paid-in capital. For example if you invest 1000 at an interest rate of 5 for ten years the future value of your investment would be. A 10-year 7 lease would have a capitalization factor of 702 present value of ordinary annuity.

Present Value 2000 1 4 3. 60054511 60060231k The exemption does not apply to amounts an individual contributes to a retirement account or individual retirement annuity. More study material from this topic.

The date of death is January 1 2021. A 7-times expense approach roughly equates to an average remaining lease term of 10 years at a borrowing rate of 7. Related to the purchase of group annuity contracts to transfer 49 billion of gross pension obligations to an insurance company in the third quarter of 2021.

Of course this is if the contribution occurs within 120. Since the useful life of the machine is 10 years the factor would be found in 10-period line or row. In this example alternate valuation is adopted.

Value from present value of an annuity of 1 in arrears table. Calculate the profitability index for each product. House and lot 1921 William Street NW Washington DC lot 6 square 481.

Calculation Using a PV of 1 Table The present value of receiving 5000 at the end of three years when the interest rate is compounded quarterly requires that n and i be stated in quarters. Such a flow of cash is known as even cash flow. How to mathematically derive present value formulas for a future sum annuity growing annuity perpetuity with continuous compounding.

NPV Net Present Value Formula Example 2. There is a minimum allocation of 1000 per value and a minimum transfer of 10 of your contracts value. The present value of each of the cash flows is the value of the annuity.

Methods for the evaluation of capital investment analysis. Present value of ordinary annuity table. Present Value of Terminal Value PVTV TV 1 r 10 UK51b 1 64 10 UK27b The total value or equity value is then the sum of the present value of the future cash flows.

The mortality factors from Table 80CNSMT Table 90CM or Table 2000CM are also used if the interests. PVIFA 11i 11i2.

Solved Table 1 Future Value Of 1 Fv 1 1 I 20 0 Chegg Com

2

Present Value Of 1 Table Accountingexplanation Com

Present Value Of 1 Annuity Table

Solved Table 2 Present Value Of 1 Pv N I 1 0 1 5 2 0 Chegg Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Present Value Of An Ordinary Annuity Of 1 Download Table

Appendix Present Value Tables Financial Accounting

Present Value Of Ordinary Annuity Table Accountingexplanation Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Table 4 Present Value Of An Ordinary Annuity Of 1 Chegg Com

Future Value Of 1 Table Accountingexplanation Com

Solved Table 4 Present Value Of An Ordinary Annuity Of 1 1 Chegg Com

Solved Table 1 Future Value Of 1 Fv 1 1 I N Table 3 Chegg Com

Solved Table 6 Present Value Of An Annuity Due Of 1 1 I Chegg Com

2

Solved Table 1 Future Value Of 1 Fv 1 1 I N I 1 0 Chegg Com